- Rollover boosts cash-strapped nation’s international alternate reserves.

- Pleasant nations’ help bettering financial indicators, PM says.

- Exim Financial institution of China newest establishment to roll over Pakistan’s mortgage.

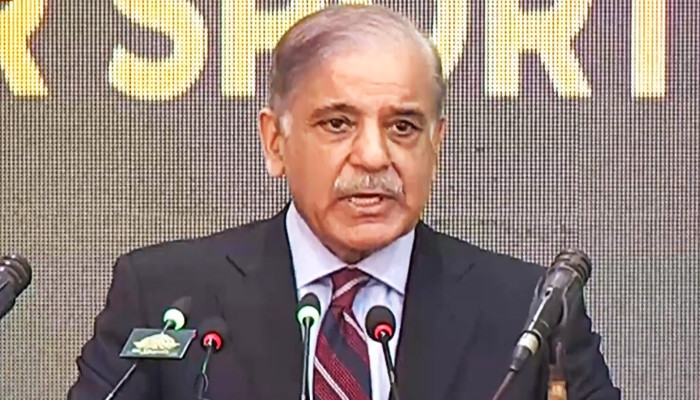

Prime Minister Shehbaz Sharif stated Tuesday {that a} financial institution in China rolled over a $600 million mortgage to Pakistan, boosting the cash-strapped nation’s foreign exchange reserves.

The premier was addressing the launching ceremony of the Prime Minister’s Youth Sports activities Initiative in Islamabad, the place he introduced to allocate extra funds for the event of the youth if he comes into energy once more.

“Yesterday, Exim Financial institution of China rolled over $600 million to Pakistan, which elevated our international forex reserves,” PM Shehbaz Sharif stated and added that help from pleasant nations is bettering financial indicators.

Nevertheless, he didn’t elaborate additional on when this cost was due.

The nation is displaying indicators of financial stability after the Worldwide Financial Fund (IMF) authorised a $three billion bailout programme and transferred the primary tranche of $1.2 billion beneath a nine-month stand-by association.

Having teetered getting ready to a sovereign debt default, Pakistan earlier this month additionally obtained $1 billion from the United Arab Emirates and $2 billion from Saudi Arabia, as each had been reassured by the settlement struck between Islamabad and the IMF on the finish of June.

Pakistan’s international alternate reserves held by the central financial institution barely elevated by $61 million to face at $4.524 billion within the week ending July 7, the State Financial institution of Pakistan stated final Thursday.

IMF projections

An IMF assertion stated the bailout programme would give attention to an appropriately tight financial coverage aimed toward curbing worth pressures within the South Asian nation of 220 million folks.

The IMF expects inflation to common 25.9% in fiscal 12 months 2024, although it anticipates a considerable moderation to round 16% in the direction of the top of that interval.

With the important thing coverage fee at 22%, the federal government has projected inflation at 21% for fiscal 2024.

“A continued tight, proactive and data-driven financial coverage is warranted going ahead,” the IMF assertion stated.

The ailing Pakistani economic system has confronted an acute steadiness of funds disaster with solely sufficient central financial institution reserves to cowl barely a month of managed imports. The IMF initiatives it’s going to have an import cowl of 1.Four months in fiscal 2024.

The IMF deal, a lifeline for Pakistan after it was on the cusp of default, got here after eight months of robust negotiations over fiscal self-discipline.

“A market-determined alternate fee can also be vital to absorbing exterior shocks, lowering exterior imbalances, and restoring development, competitiveness, and buffers,” the IMF stated.