ISLAMABAD:

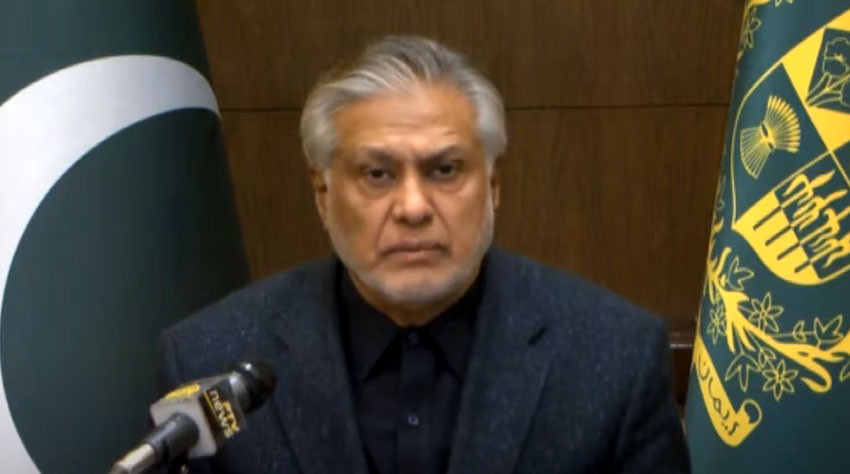

Finance Minister Ishaq Dar on Thursday placed on courageous face, expressing optimism that Pakistan wouldn’t default on its exterior repayments as the federal government struggled to resolve an acute steadiness of funds disaster within the absence of a take care of the Worldwide Financial Fund.

The assertion got here because the IMF mentioned in a scheduled press convention in New York that Pakistan wants important further financing for a profitable completion of the long-stalled ninth assessment bailout bundle.

A staff-level accord to launch a $1.1 billion tranche out of a $6.5 billion IMF bundle has been delayed since November, with almost 100 days gone for the reason that final workers stage mission to Pakistan. That’s the longest such hole since at the least 2008.

“Pakistan has fulfilled all of the IMF situations [for the revival of its loan programme]. It took steps to satisfy these situations. The federal government has ensured its exterior repayments until December,” Dar mentioned whereas talking at a session on the nation’s financial challenges throughout an occasion titled ‘Islamabad Safety Dialogue-2023’.

Commenting on a world credit standing company’s report on Pakistan may defaulting on its exterior repayments, the minister mentioned if the IMF sought extra time to succeed in a staff-level settlement with the nation, it may proceed forward with it.

He added that Pakistan had organized funds to repay its exterior repayments to the tune of $3.2 billion in Could and June on time. Dar maintained that international establishments mustn’t discuss Pakistan defaulting.

He continued that the pleasant nations would quickly fulfill their pledges to finance Pakistan.

Commenting on the state of financing in Pakistan, Julie Kozack, IMF spokeswoman, mentioned that financing already dedicated by Pakistan’s exterior companions was welcomed.

The United Arab Emirates, Saudi Arabia and China got here to Pakistan’s help in March and April with pledges that may cowl among the funding deficit.

On Thursday, the State Financial institution of Pakistan reserves fell $74 million to $4.38 billion, barely a month’s value of imports.

“Our crew may be very closely engaged in fact with the Pakistani authorities, as a result of Pakistan certainly faces a really difficult state of affairs,” mentioned Kozack. She added that the massive South Asian economic system was going through stagflation and had additionally been battered by a sequence of shocks together with extreme floods.

Pakistan has dedicated to not implement a cross-subsidy programme, an IMF spokesperson informed Bloomberg Information. The federal government additionally is not going to introduce new tax exemptions and can “durably permit” a market-based alternate price for the rupee forex, the IMF informed Bloomberg on Thursday.

In March, Prime Minister Shehbaz Sharif proposed charging prosperous customers extra for gas, with the cash raised used to subsidize costs for the poor who’ve been hit arduous by inflation.

Additionally learn: AJK PM discusses funds with Dar

The proposed scheme was seen as one of many causes for the delay in implementing the IMF bailout. The cash-strapped nation of 220 million individuals now faces a recent set of challenges within the type of political turmoil.

The rupee fell 2.91% towards the buck on Thursday to shut at a brand new low of Rs298.93.

“The debt to danger value may be very excessive. It’s extremely troublesome to see how the nation manages to service its debt over the subsequent few years,” mentioned Diliana Deltcheva, Head of Rising Market Debt at Candriam. Danger premiums had been extra prone to rise than fall, she mentioned.

“We do count on as a crew that there are a couple of nations that will not make it over the close to to medium time period. Pakistan is on that listing subsequent to Egypt and Kenya. We predict they could require some kind of debt restructure,” mentioned Deltcheva.

Bloomberg acknowledged that there was round $2.6 billion left to disburse from the $6.7 billion programme that was scheduled to run out on the finish of June.

In an interview with Bloomberg TV earlier, Minister for Petroleum Musadik Malik mentioned the IMF had hesitations concerning the gas subsidy plan, which might have raised costs “for wealthier motorists to finance subsidies for lower-income prospects”.

The IMF funds are wanted for the federal government to keep away from a default on its exterior debt. The state of affairs has worsened because the rupee misplaced a 3rd of its worth during the last 12 months, contributing to report inflation whereas sending rates of interest to an all-time excessive.

Pakistan additionally wants to verify different funding that it expects to obtain earlier than the programme resumes, which is critical to assist the nation enhance its international alternate which stands “at a critically low stage of $4.5 billion and covers nearly one month of imports”.

Earlier, Moody’s Traders Service warned that Pakistan may default with out an IMF bailout because the nation confronted unsure financing choices past June.

“With protesters on the streets, the IMF will likely be much more cautious about restarting the mortgage deal,” mentioned Gareth Leather-based, senior economist for Rising Asia at Capital Economics.

JPMorgan analyst Milo Gunasinghe mentioned little reduction from political uncertainty was in sight whereas the IMF programme remained stalled.

“The newest developments probably dampen any prospect of a political breakthrough throughout either side,” Milo added.

(With enter from businesses)