It’s been some time since 3D printers turned accessible and began permitting individuals to create 3D objects in the actual world proper from their very own dwelling.

For those who’re involved in getting a rundown of what 3D printers are, how they work, how a lot they price, and what you may do with them, you’ve come to the best place.

What’s a 3D printer?

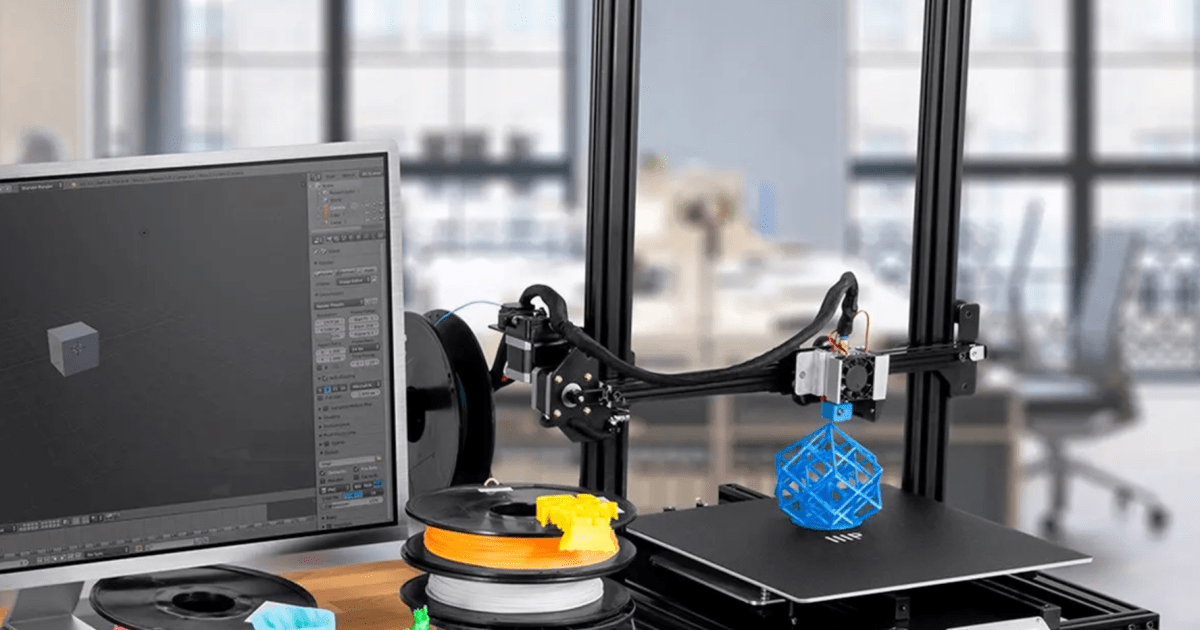

A 3D printer is a tool that may create bodily objects from a digital file. The result’s normally plastic. It might need tough edges and is commonly a single coloration. Regardless of these limitations, holding a real-world copy of a 3D mannequin makes it simpler to get a way of what works and what doesn’t.

The perfect 3D printers can create components which can be sturdy sufficient for on a regular basis use. The long-term objective of the business is to increase the lifetime of client merchandise, permitting anybody to print an important substitute half that the producer now not retains in inventory.

Whereas recreating a lacking or damaged half is helpful, a 3D printer may create sufficient components to assemble complete merchandise. This expertise is nice for speedy prototyping, permitting fast adjustments to refine the design earlier than committing to costly injection molds for high-volume manufacturing.

And 3D printing additionally has a spot in industrial manufacturing. When producing a small variety of merchandise, high-quality, however comparatively gradual and costly 3D printing of components typically makes extra sense than conventional strategies with excessive preliminary prices and a low price per unit.

How do 3D printers work?

The commonest 3D printer design, Fused Deposition Modeling (FDM), is just like an inkjet printer. The FDM printhead strikes facet to facet, depositing materials on a shifting platform. Whereas an inkjet printer sprays drops of ink on paper, a 3D printer extrudes scorching plastic onto a glass or metallic construct plate.

Two computer-controlled motors direct the circulate of plastic alongside the size and width of the completed object, one for the printhead and one other for the construct plate. To create top, a 3rd motor raises the rail the printhead slides throughout.

On the detrimental facet, 3D printing is a gradual course of in comparison with conventional manufacturing strategies, typically taking hours to construct an object up into the third dimension. You can also make it sooner by extruding extra materials directly, however that will increase layer top and ends in a print that feels tough. Vertical curves and angles even have steps as a substitute of the sleek surfaces and flat planes of most manufactured merchandise.

The second-most well-liked client 3D printer sort makes use of gentle as a substitute of warmth to kind shapes in plastic. Referred to as a resin 3D printer, this kind makes use of UV gentle to venture a picture onto liquid resin that reacts to that wavelength and solidifies.

Resin 3D printing is commonly faster, curing a whole layer directly. Nonetheless, UV resin normally isn’t as sturdy because the thermoplastics used for FDM 3D printing.

Particular FDM filaments embody extra sturdy plastic, in addition to a number of forms of metallic, glass, ceramic, and even wooden. The 3D printer half takes on look and a few of the traits of these supplies. With specialised 3D printers, it’s doable to create objects in a wide range of supplies, even cheesecake.

What can a 3D printer make?

Industrial 3D printers could make virtually something. Some 3D printers use highly effective lasers to soften metallic, creating robust components to be used in rockets and different rugged equipment.

Client-grade 3D printers are restricted in measurement and supplies. The dimensions of the construct plate determines the utmost size and width of a component, whereas the peak of the printer impacts how tall a 3D-printed object will be.

Normally, 3D prints will match within the palm of your hand. Bigger client 3D printers can deal with objects somewhat over a cubic foot. It’s additionally doable to make a big object by assembling a number of smaller components.

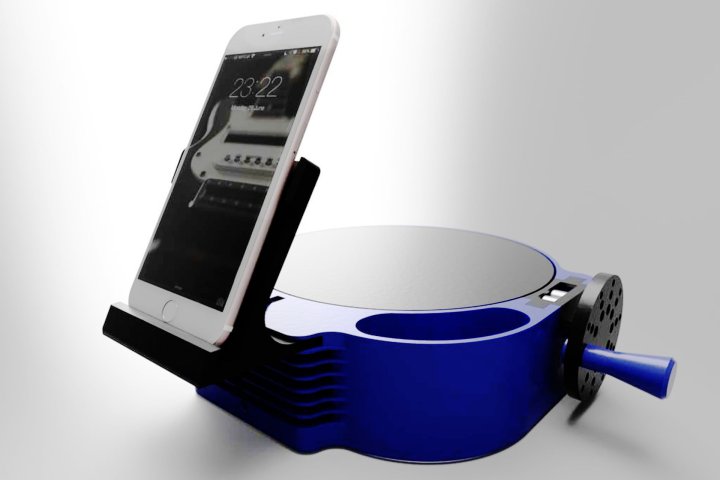

Among the hottest 3D objects embody a whistle, a cellphone holder with a handbook turntable for scanning objects in 3D, a intelligent digital sundial that makes use of daylight to solid a shadow that tells the time in easy-to-read digits, and a mini octopus with versatile hinged legs that requires no meeting.

The probabilities are limitless. For instance, Thingiverse is likely one of the largest libraries of 3D objects designed for 3D printing, with over 2.5 million digital recordsdata — and most are free.

With the rise of generative AI, it’s now doable to create 3D objects with textual content prompts. At current, AI isn’t creating designs optimized for 3D printing, so that you would want to transform the file to a suitable format and course of it via a 3D-printing app earlier than use.

How a lot do 3D printers price?

You should purchase 3D printers beginning at about $100, an unbelievable discount for such highly effective expertise. Extra superior fashions have bigger construct plates and sooner print speeds, however price extra.

For round $300, you will get an excellent client 3D printer. For those who change into an fanatic who prints typically, $500 to $1,000 will get you a a lot sooner and bigger 3D printer. Industrial 3D printers vary from just a few thousand {dollars} to over $1 million.

Bear in mind you’ll want provides and would possibly need equipment in your 3D printer, so hold somewhat extra within the price range for these added prices. FDM filaments and UV resin are comparatively cheap, however are offered in bulk, so that you’ll spend no less than $20 to get the mandatory provides.

Equipment embody an enclosure to scale back the noise of an FDM 3D printer, higher construct plates, cooling followers to permit sooner printing, UV lights to harden resin, and instruments for 3D printer cleansing and upkeep. You normally don’t want equipment to get began, and a few 3D printers include a small quantity of filament or resin to create the primary few prints.

A 3D printer unlocks the potential to inexpensively create substitute components, duplicate designs which can be accessible on-line, or prototype solely new merchandise that don’t but exist. This unbelievable expertise has been round for decade,s however solely turned reasonably priced and straightforward to make use of in the previous couple of years.

For those who haven’t explored 3D printing lately, it’s time to take one other look. For those who’re new to 3D printing, now is a good time to get began.

Editors’ Suggestions