September 01, 2023 11:38 pm | Up to date September 02, 2023 01:13 pm IST – New Delhi

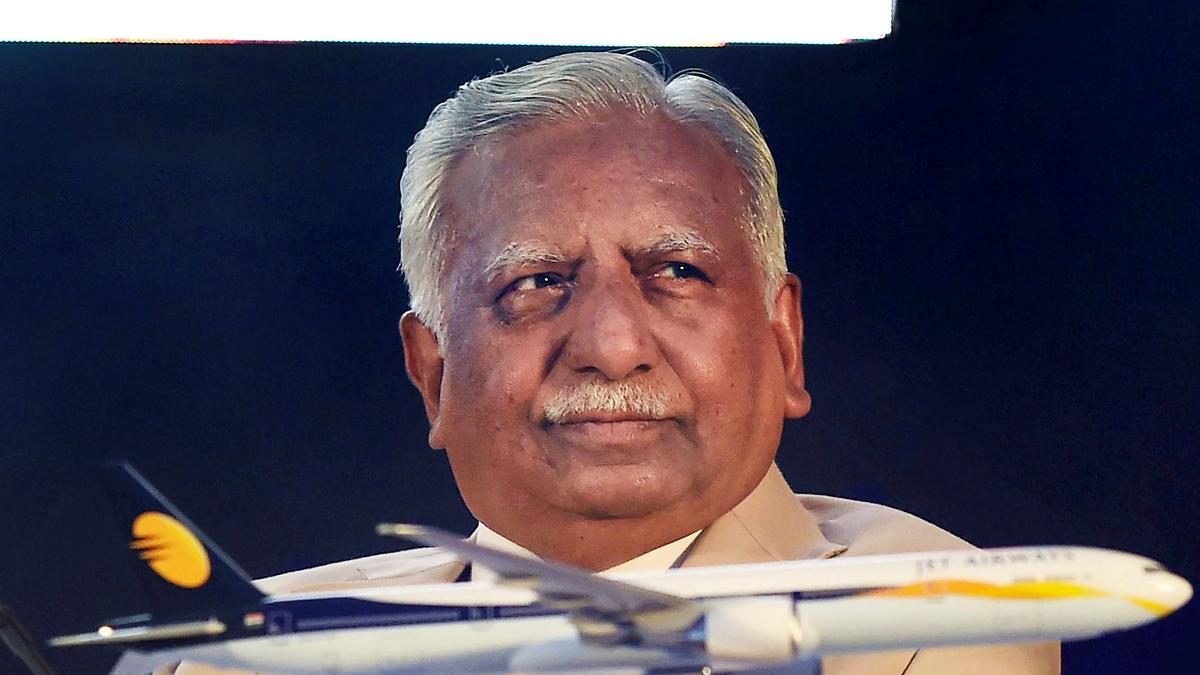

File picture of Naresh Goyal.

| Photograph Credit score: PTI

The Enforcement Directorate on September 1 arrested Jet Airways (India) Restricted’s founder chairman Naresh Jagdishrai Goyal, in reference to an alleged mortgage fraud involving about ₹538.62 crore of the Canara Financial institution.

Mr. Goyal had been summoned to the ED’s Mumbai workplace for recording his assertion. He was arrested following questioning.

The ED probe is predicated on a case registered by the Central Bureau of Investigation (CBI) in Could. Amongst these named as accused have been the corporate, Mr. Goyal, his spouse Anita Naresh Goyal and Gaurang Ananda Shetty.

As alleged, the corporate was initially sanctioned a working capital restrict of ₹126 crore and inland letter of credit score/monetary financial institution assure restrict of ₹100 crore for various functions. It additionally acquired ₹400 crore as time period mortgage for operational expenditures and ₹200 crore for plane reconfiguration, introduction of recent routes, enterprise promotion and different related actions, apart from ₹17.52 crore as short-term mortgage.

The First Data Report alleged that since August 2018, the corporate began claiming that it had been dealing with liquidity and operational points, and was not capable of service the fee or reimbursement obligations. In October 2018, the lenders determined to invoke the inter-creditor settlement provisions and the State Financial institution of India was appointed the chief.

Jet Airways was informed to submit a decision plan and infuse ₹3,500-₹4000 crore. Nevertheless, the circumstances weren’t fulfilled and the corporate additionally defaulted on fee of instalments as on December 31, 2018. The banks then took the matter to the Nationwide Firm Legislation Tribunal. In April 2019, Jet Airways had suspended its operations.

The Canara Financial institution mentioned its mortgage account turned a non-performing asset on June 5, 2019. A forensic audit of the corporate’s financials throughout the verify interval from April 1, 2011 to June 30, 2019, subsequently detected alleged diversion and siphoning of funds.

As alleged, associated events have been paid ₹1,410.41 crore out of the full fee bills; and there was siphoning of funds via Jet Lite (India) Ltd. via advances or investments after which, the identical written off. Throughout 2011-18, ₹14,552.44 crore was prolonged as mortgage to Jet Lite and ₹13,529.62 crore was acquired in return, it was alleged.

The financial institution additionally alleged that Jet Airways was transferring borrowed funds to subsidiary/group entities via varied methods. Through the evaluation interval, ₹1152.62 crore was paid for skilled and consultancy companies. Of those, alleged suspicious transactions value ₹197.57 crore have been detected in case of the linked entities.

Over ₹420 crore was paid to the entities whose nature of enterprise was completely different from the service description of their invoices raised on the corporate, as alleged.