- GDP progress anticipated to expertise a modest restoration.

- Inflationary pressures to stay elevated amid hike in vitality tariffs.

- Continued weakening of rupee to additionally influence inflationary pressures.

The Asian Improvement Financial institution (ADB) has expressed optimism relating to Pakistan’s financial prospects, highlighting that the reform programme and easy conduct of upcoming normal elections are prone to restore investor confidence within the nation’s economic system.

The regional monetary establishment, in its report launched on Wednesday, underscored the importance of Pakistan’s dedication to an financial adjustment programme till April 2024, which is essential for reestablishing macroeconomic stability and facilitating the gradual resurgence of financial progress.

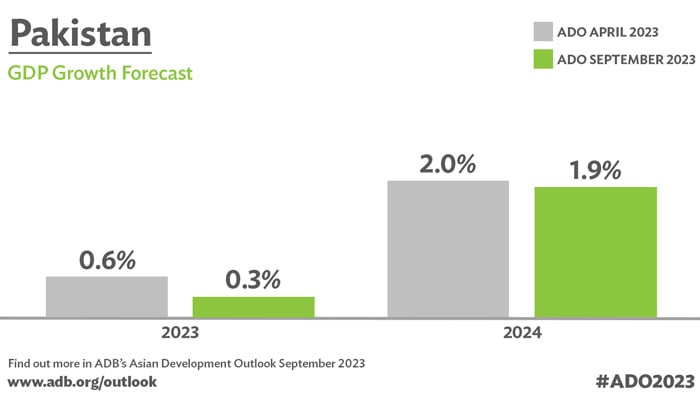

In keeping with the Asian Improvement Outlook (ADO) for September 2023, Pakistan’s gross home product (GDP) progress is anticipated to expertise a modest restoration, growing from 0.3% in FY2023 to 1.9% in FY2024, though inflationary pressures are anticipated to persist.

Nonetheless, vital draw back dangers to the outlook stay, together with world value shocks and slower world progress.

The ADB additionally anticipates a lower in Pakistan’s inflation tendencies to 25% in FY2024 from the elevated 29.2% skilled in FY2023 within the wake of base-year results setting in, normalisation of meals provide, and a moderation in inflation expectations.

“Nonetheless, sharp will increase in vitality tariffs beneath the financial adjustment programme, and the continued weakening of the rupee will preserve inflationary pressures elevated,” it added.

In keeping with the Asian Improvement Financial institution (ADB), the gross home product (GDP) progress of Pakistan is anticipated to expertise a modest restoration, reaching 1.9% within the fiscal 12 months 2024 (spanning from July 1, 2023, to June 30, 2024), marking an enchancment from the meagre 0.3% progress recorded in FY2023.

This anticipated restoration will come amidst the persistence of elevated value pressures, and there stay vital draw back dangers to this outlook, primarily stemming from potential world value shocks and the potential for a slowdown in financial progress all over the world.

ADB Nation Director for Pakistan Yong Ye mentioned that the nation’s financial prospects are intently tied to the steadfast and constant implementation of coverage reforms to stabilize the economic system and rebuild fiscal and exterior buffers.

“Higher fiscal self-discipline, a market-determined change fee, and speedier progress on reforms within the vitality sector and state-owned enterprises are key to reviving financial progress and defending social and improvement spending,” he added.

Pakistan’s economic system, in FY2023, has confronted a collection of challenges, together with extreme floods, world value shocks, and political instability, collectively resulting in weakened financial progress and a rise in inflation.

In keeping with the ADO, the implementation of the financial adjustment programme and a easy normal election in FY2024 are anticipated to spice up confidence, whereas easing import controls is prone to assist funding, the ADB mentioned.

“Beneficial climate situations coupled with authorities initiatives comparable to distributing free seeds, providing subsidised credit score, and offering fertilisers are projected to bolster the restoration of the agricultural sector,” the report talked about, including that this can have a “constructive spillover impact on the commercial sector, which is able to profit from improved entry to important imports.”

In its report, the monetary establishment mentioned it stays steadfast in its dedication to attaining prosperity, inclusivity, resilience, and sustainability in Asia and the Pacific area.