- Inflation fell to 27.4% in August; meals inflation stays at 38.5%.

- Rupee slides to all-time low, falling 6.2% within the final month alone.

- SBP stated July inflation to be on downward path over subsequent 12 months.

KARACHI: Searching for to sort out sky-high inflation and bolster diminished overseas alternate reserves which have despatched the rupee to document lows, Pakistan’s central financial institution is anticipated to hike charges when it meets to resolve on financial coverage on Thursday.

Financial and political crises have seen the State Financial institution of Pakistan elevate its benchmark price by 12.25% factors to 22% since April 2022, though it held the speed regular at its final assembly in July.

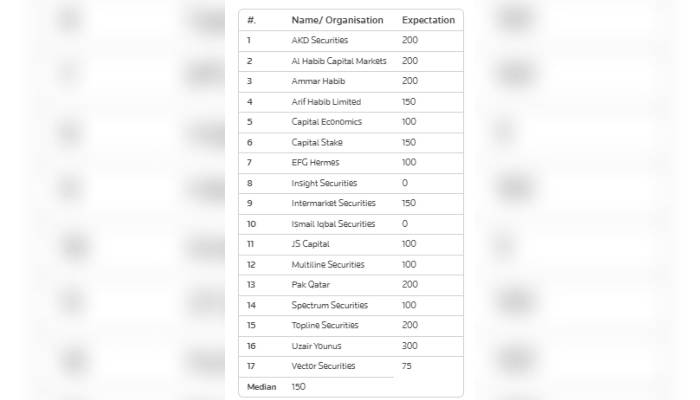

A Reuters ballot of 17 analysts exhibits that 15 are forecasting a price hike. Of these, 9 predict a rise of no less than 150 foundation factors (bps). The opposite two analysts count on the speed to stay unchanged.

The South Asian nation is making an attempt to navigate a difficult path to financial restoration below a caretaker authorities within the wake of a $three billion Worldwide Financial Fund (IMF) mortgage programme, accredited in July, which helped avert a sovereign debt default.

Reforms set out as situations for the mortgage have difficult the duty of conserving value pressures and declines within the rupee in examine. An easing of import restrictions and the elimination of subsidies — each situations of the bailout — have fueled spikes in vitality costs.

Though total inflation fell barely to 27.4% in August, meals inflation stays elevated at 38.5%.

The rupee has additionally slid to all-time lows, falling 6.2% within the final month alone, though it has recovered some floor in latest days after a crackdown on unlawful overseas alternate transactions.

“The latest forex depreciation can be a key cause why one other price hike is probably going, particularly since using foreign-exchange reserves that are nonetheless very low is just not a viable choice,” stated Shivaan Tandon, economist at Capital Economics.

He added that whereas import controls have been relaxed, the transfer has pushed the present account again right into a deficit, which pushes up the prices of imports and paying debt.

“Since import controls are not an choice as nicely, as a result of IMF settlement, policymakers could should resort to tighter financial coverage to curtail demand and rein within the deficit,” he stated.

Pakistan’s central financial institution stated in July that it expects inflation to be on a downward path over the subsequent 12 months.

Analysts additionally famous that rises in cut-off yields in treasury invoice auctions — the best yield at which a bid is accepted — point out that market members count on a price hike.