ISLAMABAD-Terming enhance in BISP allocation within the finances 2023-24 as a swift manner of gaining political advantages, Pakistan Institute of Improvement Economics has stated that somewhat, larger funds ought to have been diverted towards training.

Concerning as much as 35 % hike in salaries within the proposed finances, PIDE has really helpful that it ought to have been elevated just for BPS 1-16, with no enhance in different allowances, as for the grade 17 and above already 150% govt allowance has been supplied. The suggestions on the proposed finances 2023-24 have been offered by PIDE to federal authorities in its report on ‘Maximizing the Influence: Evaluating the FY 2023-24 Finances for Optimum Useful resource Allocation, Socio-Financial Addressal, and Sustainable Improvement’. It has been ready by the PIDE Macro Coverage Lab.

The exemption on customized obligation on import of uncooked materials for batteries, photo voltaic panels and inverters is encouraging as the federal government has learnt that banning imports affected the nation’s exports prior to now. Nonetheless, it’s important for the federal government authorities to observe the coverage impression in order that the nation ought to obtain its meant progress goals. Speaking about bilateral import obligation reductions, PIDE stated that awarding favor of zero % import obligation on imports by sure Arab nations is a questionable transfer. Excessive duties on import of automobile components will work in favor of the already extremely protected, inefficient car sector, dominated by three firms which have loved govt’s safety towards competitors. Many years of safety afforded to home producers beneath the guise of toddler business and different excuses has resulted in solely 11 % domestication of components manufacturing plus doling out low-quality autos at very excessive charges within the nation.

Speaking of detrimental results of withholding taxes, it has been famous that withholding tax on money withdrawal will significantly dent monetary inclusion. To facilitate this transition, the usage of digital funds must be promoted and ensured in sure instances. Corresponding to funds to be made at shops and petrol purchases and so on. The federal government fails to counsel any measure to extend the tax internet, which exhibits the myopic nature of the finances. Agricultural revenue is just not thought of and the retail sector is just not introduced within the tax internet. It has been really helpful that there’s a have to prioritize and help sectors which have the potential to generate larger value-added outputs, create employment alternatives, and contribute to total financial growth. By forcing a 3.5 % GDP progress price upon itself, the federal government has dedicated to larger public consumption bills somewhat than incentivizing the non-public sector to take up the mantle of funding that might spur GDP progress. The idea of a authorities setting GDP progress price is controversial to start with, since it’s tough to inform what circumstances can be a month, 1 / 4 or two quarters from now. The federal government is once more incentivizing the true sector greater than the manufacturing sector. Agriculture and IT sector focus is nice, however now we have to give attention to the export sector extra for actual productiveness beneficial properties, in any other case we might at all times get again to sq. one.

Federal authorities additionally proposed a number of allocations for agriculture sector together with tax exemptions to meals processing. Nonetheless, contemplating that agriculture is a provincial topic submit 18th Modification, such measures must be introduced by the provinces? Second, inside these exemptions, one once more finds the failure to ameliorate home productiveness points and present bills. For instance, there are greater than 100 agricultural analysis institutes unfold throughout the nation, each on the federal and provincial stage. If high quality seeds should be imported ultimately, what’s the usage of home analysis institutes? This query assumes added significance in lieu of the billions of rupees in present bills earmarked for these institutes. Moreover, the exemptions in relation to varied types of machineries increase the query about our home capacities. And final however not the least, relative to agriculture, the sector largely stays exterior of the revenue tax internet.

Concerning Diamond Card’ for abroad Pakistanis, the report stated that it’s aimed toward extracting extra {dollars} out of the diaspora. However there is no such thing as a or little roadmap for attracting FDI, which is now all the way down to a quibble in context of our overseas loans. Neither is there any roadmap on diversify exports, which stay closely dependent upon textiles. A big enhance in authorities workers’ salaries and pensions is partially justified however it is going to put stress on the fiscal aspect. Maybe it ought to have been elevated just for BPS 1-16, with no enhance in different allowances i.e. each day and mileage allowance. For the grade 17 and above already 150% govt allowance has already been supplied.

A lump sum enhance, particularly in pensions, is just not warranted. There is no such thing as a viable proposal to deal with the pension bomb, particularly that of the armed forces whose pension share is greater than 80 %. For many who are raking in additional than 0.5 million in pensions and wages (like Judges of Supreme Courtroom and Excessive Courtroom), there’s little or no want for growing their wages on the identical price as that of low wage workers. The pension fund is a welcome step. Pensions must be contributed by the people/authorities, in any other case pensions can be unsustainable and the most important expenditure of the federal government in a few years.

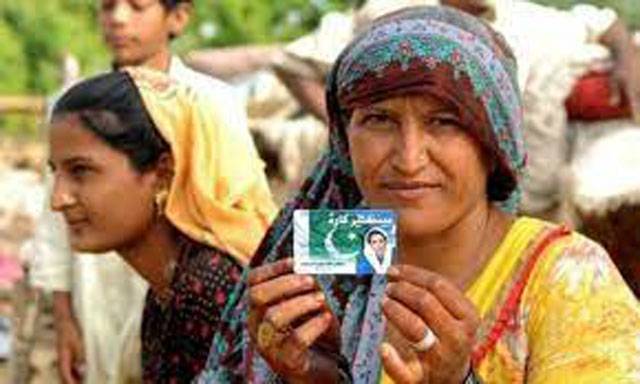

The federal government has once more relied on burdened social sector packages like BISP – a swift manner of gaining political advantages. Fairly, larger funds ought to have been diverted towards training. Social sector safety is vital however given the federal government’s very weak monetary place, it must be focused. Relaxation, the federal government is just not a welfare group, it ought to make its residents self-sustainable which contributes and will not be simply on the receiving finish.

Whereas questioning medical health insurance for journalists, PIDE requested why would solely journalists be afforded medical health insurance? Why not proceed with the common medical health insurance that had been prolonged to all of the nation? The one factor wanted was to depoliticize that program and proceed its funding and enchancment in service supply. Implementation of Minimal Wage (MW) may be very laborious particularly for small companies. India has a number of MW buildings primarily based on many components. Due to this fact, targets set for MW should not be formidable. The report has really helpful for bettering the energy of labour officers (for factories inspection) and labour inspectors (for retailers and institution inspection).It has additionally been really helpful to make sure the switch for MW by way of financial institution accounts in order that compliance is ensured.

Within the vitality sector, it’s the standard story of subsidies for sustaining uniform tariffs throughout the nation, even for the privatized utility Okay-electric. On one hand, the GOP is within the technique of implementing the Aggressive Buying and selling Bilateral Contract Market (CTBCM); to generate competitors amongst market gamers to profit shoppers by way of pricing. However subsidies allotted for tariff differential claims (PEPCO and Okay-Electrical), means enterprise as regular, continuation of inefficiencies and round debt progress. There can be no aggressive market when accounts of all distribution firms are handled as one, and the uniform tariff is charged. The privatization of state-owned distribution firms is on the GOP plan. A uniform tariff coverage isn’t any incentive for a privatized firm. Offering subsidies is just not a sustainable resolution, the ability sector wants tariff construction reforms. The burden of capability funds is growing. What we want is the productive utilization of this capability and never protecting it beneath or un-utilized. Likewise, now we have sufficient capability, there is no such thing as a level in including extra capability (even whether it is renewable) within the brief to medium run, if we actually need to eliminate round debt.

The incentives proposed within the finances on import of software program and {hardware} equal to 1% of their exports will encourage IT providers exports in the long term. Nonetheless some extra steps had been anticipated within the finances to spice up companies total. Authorities has additionally given freelancers an entry to refunds on exports as much as $24,000 yearly and exemption from gross sales tax registration. This may encourage the freelancing market. Assuming the federal government is ready to obtain its tax income goal of Rs 9,200 billion, nearly 80 % of the tax receipts can be used for curiosity repayments. It has been really helpful that authorities should look in direction of managing its long-term home debt profile as nicely, whereas additionally turning in direction of home debt restructuring. Expenditures in FY 2023-24 can be majorly debt pushed.