- Deposits are secure owing to sound banking system in Pakistan: SBP.

- Says insured quantity to be obtainable to depositors in case a financial institution fails.

- At present, 94% of depositors are absolutely protected, says Central Financial institution.

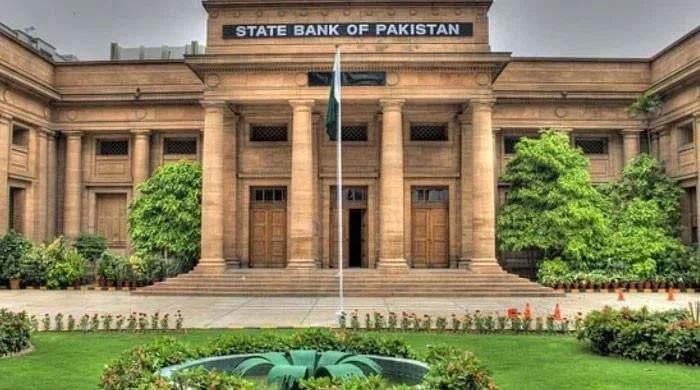

Categorically rejecting media reviews claiming deposits over Rs500,000 are unsafe within the banking system, the State Financial institution of Pakistan (SBP) on Thursday clarified that prospects’ deposits are “completely secure”.

In a press release, a spokesperson of the SBP mentioned that sure sections of the media — on the idea of a press release given by SBP Deputy Governor Dr Inayat Hussain in the course of the assembly of the Senate Standing Committee on Finance and Income — are implying as if financial institution deposits above Rs500,000 within the banking system are unsafe.

“It’s categorically acknowledged that the deposits are secure owing to a sound banking system in Pakistan beneath a strong regulatory and supervisory framework of SBP.”

The spokesperson additional mentioned that the banking system in Pakistan is sufficiently capitalised, extremely liquid and worthwhile with a low degree of internet non-performing loans.

‘Insurance coverage cowl’

Along with the soundness of the banking system, Deposit Safety Company (DPC) has added one other layer of safety by offering insurance coverage cowl of as much as Rs500,000 to each depositor.

That is according to one of the best worldwide practices and world tendencies, the spokesperson mentioned, including that the deposit safety, was one of many key components of security internet utilized by supervisory authorities and deposit safety businesses around the globe to offer safety to the depositors’ funds within the unlikely occasion of a financial institution failure.

The quantity insured by the DPC turns into instantly obtainable to depositors in case a financial institution fails, the Central financial institution added.

Nonetheless, remaining quantities of the deposits are additionally recoverable because the troubled financial institution is resolved via a regulatory-assisted course of.

At present, 94% of the depositors are absolutely protected beneath the Deposit Safety Act of 2016, added the spokesperson.