FILE PHOTO: AI (Synthetic Intelligence) letters are positioned on pc motherboard on this illustration taken June 23, 2023.

The 2022-23 report on the developments in, and progress of, banking in India, which was launched on Wednesday by the Reserve Financial institution of India (RBI), research the usage of Synthetic Intelligence (AI) in banks and the way it has grown over time. To evaluate the extent of consciousness and readiness for adopting AI in Indian banks, an analytical research was carried out on banks’ annual experiences by the RBI employees between 2015-16 and 2021-22.

This research employed a textual evaluation technique by matching key phrases particular to the area and utilising named entity recognition methods. It leveraged extensively recognised AI and Machine Studying (ML) dictionaries and glossaries from sources comparable to Google Vertex AI, Google Builders, IBM, NHS AI Lab, and the Council of Europe. Moreover, insights from Giant Language Fashions comparable to ChatGPT and Bard had been built-in into the evaluation.

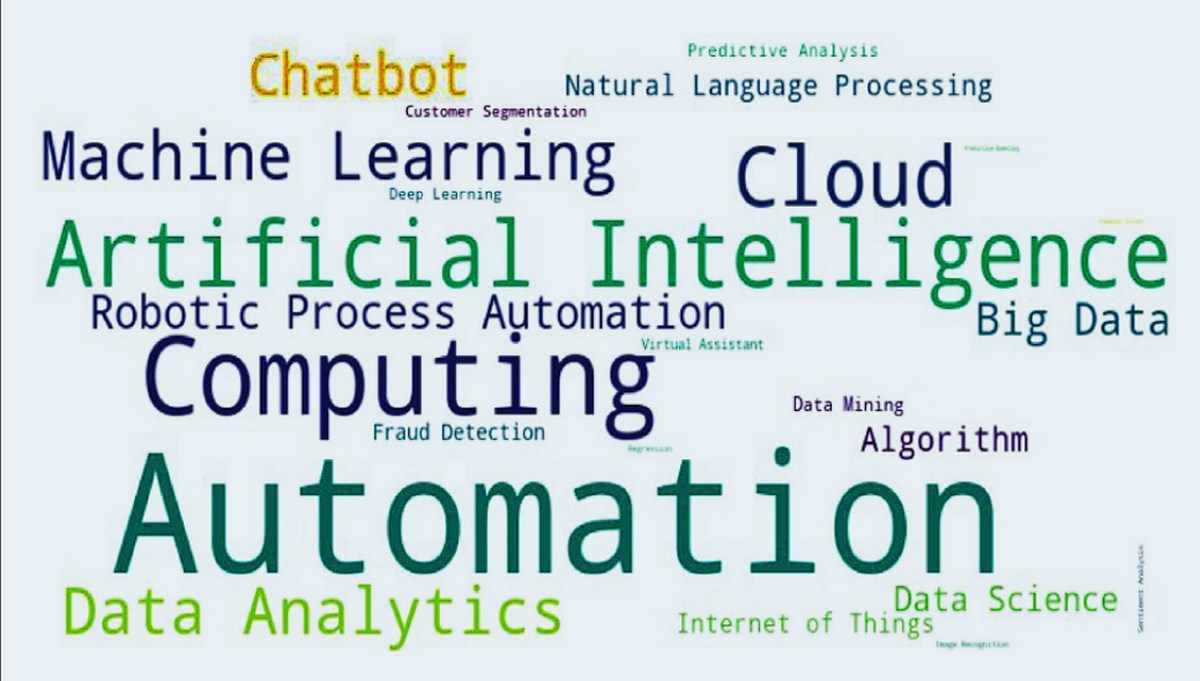

Chart 1 | The chart reveals a phrase cloud displaying textual evaluation of AI-related key phrases within the financial institution’s annual report.

Charts seem incomplete? Click on to take away AMP mode

The evaluation utilizing a phrase cloud signifies a big emphasis by banks on automation (Chart 1). This pattern doubtless stems from the aim of bettering effectivity and enhancing capabilities within the detection of fraud and different types of predictive analytics, the RBI research suggests. It’s also notable that there’s an consciousness or potential for adopting rising applied sciences comparable to Robotic Course of Automation, the Web of Issues, and Pure Language Processing.

A key utility of AI in varied service sectors is the usage of chatbots, that are able to participating in conversations with human customers in pure languages, both through textual content or voice.

Chart 2 | The chart reveals the variety of banks in India which adopted chatbots. in whole, 33 scheduled business banks had been analysed.

In FY17, solely 5 banks had opted for this facility. This incrementally grew within the following years. Now, 26 banks have this facility.

Chart 3 | The chart reveals the share of banks in India which have adopted chatbots by the top of June 2023.

Over 78.8% of the banks have adopted this facility — i.e., 26 out of the 33 scheduled business banks analysed. In accordance with the research, 11 out of 12 public sector banks (PSBs) had some type of chatbot and digital assistant by utilizing AI and ML applied sciences, by the top of June 2023. Then again, solely 15 out of 21 non-public sector banks (PVBs) had them.

Click on to subscribe to our information publication line

Chart 4 | The chart reveals the expansion within the share of PSBs and PVBs which adopted chatbots through the years.

The share of PVBs with chatbots was considerably greater than the share of PSBs in FY17. Nevertheless, the scenario reversed within the following years, with the pattern of large-scale mergers among the many PSBs showing to have influenced the adoption of chatbots, as merged entities typically undertake the expertise from their buying banks. In accordance with the RBI research, non-banking monetary firms have additionally began introducing chatbots for buyer companies.

AI instruments are extensively adopted and closely utilised in areas comparable to fraud detection, optimising data expertise operations, and digital advertising. The research argues that banks can enhance effectivity and supply higher buyer experiences by leveraging these functions. The usage of ML methods for real-time evaluation of buyer transactions enhances the estimation of default dangers. This bolsters their threat administration methods, the research suggests.

Nevertheless, the research additionally ends with a cautionary observe. AI in finance may heighten current dangers and introduce new ones, comparable to client safety issues. The opaque functioning of AI fashions complicates compliance with legal guidelines, laws, and inner controls in monetary corporations. These fashions may set off market shocks and amplify systemic dangers, notably by way of procyclicality, the research warns.

Supply: ‘Adoption of Synthetic Intelligence in Indian Banks’, revealed within the Report on Developments and Progress of Banking in India 2022-23 by the Reserve Financial institution of India.

Additionally learn: Knowledge | Non-public banks on a housing mortgage spree, 99% pay dues on time as of now

Hearken to our Knowledge podcast: Inspecting the 70-Hour Work Week: Perception or Imposition by Infosys’ Narayana Murthy | Knowledge Level Podcast